charitable gift annuity tax deduction

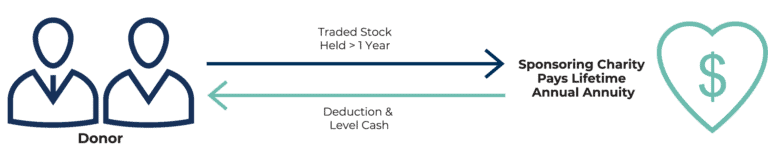

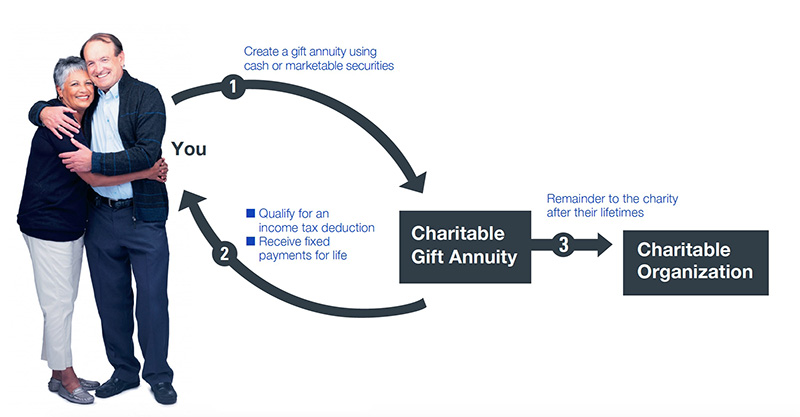

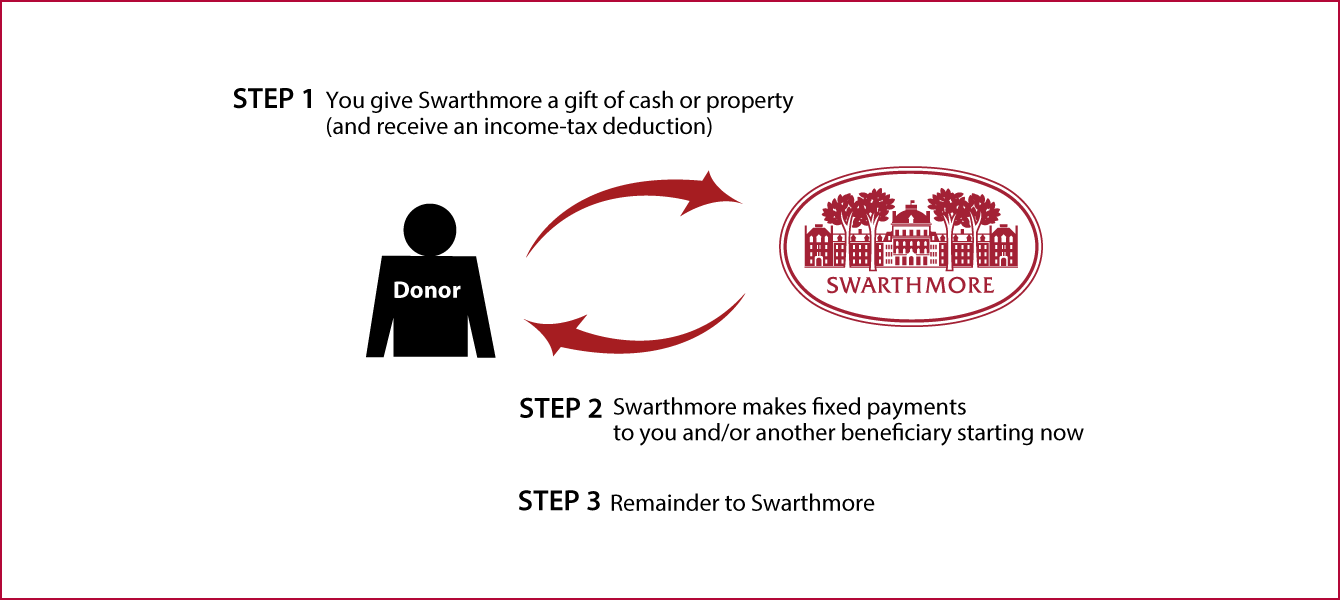

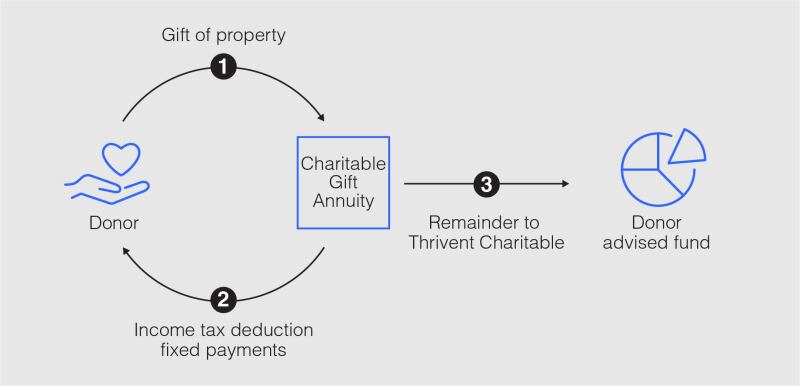

A charitable gift annuity CGA allows you to arrange a generous gift while supplementing your income with fixed payments you can count on for the rest. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return.

Charitable Gift Annuities Uses Selling Regulations

However unlike other forms of.

. Is a Humane Society gift annuity the right choice for you. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. If there is less for charity the charitable deduction is less.

Recordkeeping and filing requirements depend on the amount you claim for the deduction. Payment rates depend on several factors including your age. The lower discount rate assumes the gift assets will only earn 08 annually over the gift term leaving less for charity.

Up to 25 cash back For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return. Get this must-read guide if you are considering investing in annuities. Charitable gift annuities are the gift that gives back.

This is because with a charitable gift annuity you also receive a. A charitable gift annuity is a contract between a donor and a charity with the following terms. Provides income tax deductions.

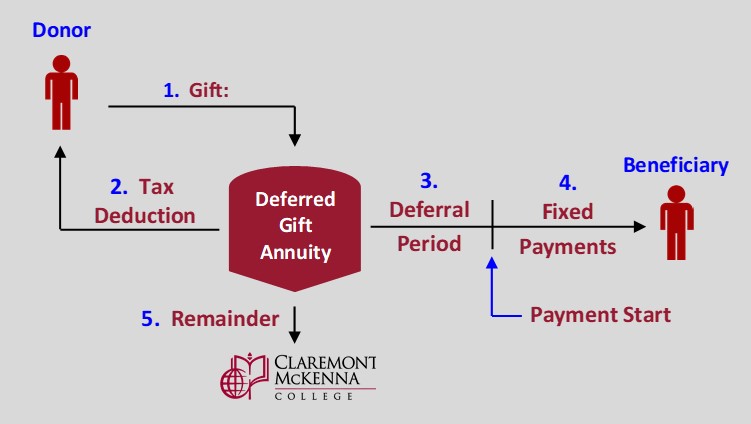

Because it is a charitable gift it generates a charitable income tax deduction for the donor. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. A deferred gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. On the tax side of charitable gift annuities the donor can take a tax deduction at the time he or she makes the donation at an amount based on the size of the charitable gift. Unlike with a charitable remainder trust part of the gift may be used immediately by the charity with the remainder of the gift invested in an account to provide for the.

When the discount rate goes down the income tax charitable deduction also goes down. A charitable gift annuity is a contract between a charity and a donor bound by some terms explained below. If you and your.

How Taxes Deductions on Charitable Gift Annuities Work. As a donor you make a sizable gift to charity using cash securities or possibly other assets. About About Home JEDI Walking Tour News Office of Equity Diversity and Inclusion.

Donors receive an upfront income tax charitable deduction of 37088 which can be used to offset taxes for the current year then up. The charity benefits because when the annuitant dies it. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

At age 65 the rate is 47 and at age 70 it goes up to 51. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

If you fund your annuity with after-tax dollars you own a non-qualified annuity. That makes sense when you consider only part of the gift annuity is a gift to. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

What is the tax deduction for a charitable gift annuity. February 23 2022 432 PM. Charitable Gift Annuity.

1 If the deduction you claim for the car is at least 250 but not more than. That is a portion may. Both charitable remainder trusts CRTs and charitable lead trusts CLTs are irrevocable trusts that can be used to benefit a favorite charity.

The Charitable Gift Annuity is at least in part a charitable gift. However the lower the discount rate the higher the tax-free return of principal. Donors benefit from the purchase of a charitable gift annuity because they get an immediate tax deduction as well as future payments.

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to a charity and the charity gives back an agreed-upon income stream to the donor for the. Ad Support our mission while your HSUS charitable gift annuity earns you income. You get an immediate.

Understanding a Charitable Gift Annuity. The donor makes a considerable gift to. As with any other.

1 Best answer. Understand the relationship between gift tax and estate tax. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Provide long-term support to your favorite causes. Y es you would only enter the amount that the recipient specifies. The payments start on a date you choose that is at least one.

The trusts are wealth transfer. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study.

You receive an immediate tax.

Gift Annuity Two Birds One Stone Benefiting Others In The Near Term And Yourself Over The Long Term Http Pwc To 1ga Early Retirement Annuity Two Birds

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuity Tax Deductions Cga Rates Ren

Charitable Gift Annuities The Field Museum

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

Swarthmore College Gift Planning Charitable Gift Annuity

What Is A Charitable Gift Annuity Thrivent

City Of Hope Planned Giving Annuity

Cga Archives Gordon Fischer Law Firm

Charitable Gift Annuity Deferred University Of Virginia School Of Law

Deferred Payment Charitable Gift Annuities Claremont Mckenna College

Charitable Gift Annuities Barnabas Foundation

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Planned Giving Charitable Annuities Trusts Princeton Theological Seminary